Data Center Intelligence - Weekly Roundup (Dec 8-14)

December 17, 2025

Lately, the blend of tech and energy has been changing the game for a lot of industries, with AI really taking the lead in exploring new possibilities. The way data centers are working; super important for running AI apps; is changing fast because of the new demands for better infrastructure and greener energy options. Companies are eager to tap into the potential here, and there’s a lot going on that shows the hurdles and innovations that come with this fast-paced shift. So, let’s take a look at some key market movements and new trends that show how businesses are adjusting to the growing need for AI while facing the challenges of energy use, regulations, and the effects on local communities.

Market Moves & Industry Trends

Industry trends, deals and capital flows

Hut 8 pivots from bitcoin mining to AI data center landlord

Hut 8 announced a fifteen year, seven billion dollar agreement with Fluidstack, backed by Anthropic, for 245 megawatts of AI compute at its River Bend campus in Louisiana, with options that could eventually take the site and related locations above two thousand megawatts of capacity. Barron's+1

Why this matters

This is another clear signal that legacy crypto miners are recycling stranded power access and balance sheets into AI infrastructure. For a non industry reader, think of a coal town converting its rail lines and land into a logistics hub. For investors, this is not a one off story, it is a template for how distressed or power rich assets can re rate as AI capacity rather than fade away with bitcoin cycles.

NextEra and Google deepen their US power and capacity partnership

NextEra Energy and Google expanded their relationship with new agreements that bundle clean energy, firm capacity and grid services to support US data center build out. The new deals add to an already large portfolio of renewables and flexible gas assets tied to Google load and underline that speed to power is now as important as land for campus selection. Reuters+1

Why this matters

This is not just a green branding story. It shows that big tech is willing to sign complex, multi decade contracts to lock in both megawatts and price visibility. For lenders and developers, these structured agreements are becoming the reference playbook for large AI campuses in constrained grids.

AI infrastructure demand pushes physical kit up nearly twenty percent

Dell Oro reported that data center physical infrastructure revenue grew about eighteen percent year over year in the third quarter, led by power gear and advanced cooling sold into AI and high density builds. The firm notes that spending is concentrating in a relatively short list of global operators and hyperscalers. Dell'Oro Group

Why this matters

This confirms what most people feel anecdotally. The bottleneck has shifted from servers to everything around them. Transformers, switchgear, backup power and cooling are where the revenue growth and lead time risk now sit. For anyone modeling the sector, it reinforces a simple point. Capital intensity per megawatt is still grinding higher, and that supports higher rents where power is scarce.

Global review underscores uneven supply and tightness in key markets

DC Byte published its twenty twenty five industry review, highlighting strong growth in capacity but even stronger growth in demand, especially in London, Northern Virginia and several Asia Pacific metros. The report calls out that AI training and inference loads are stacking on top of legacy cloud, rather than replacing it, and that grid constraints are the real cap on expansion. dcbyte.com

Why this matters

From a finance perspective, this is why you see long queues for capacity, long pre lease cycles and increasing use of forward commitments. For non industry readers, the easy analogy is airports. You can add more flights only if you have gates and runway slots. The industry currently has more planes than available gates in several core markets.

Credit quality of AI tenants comes under the microscope

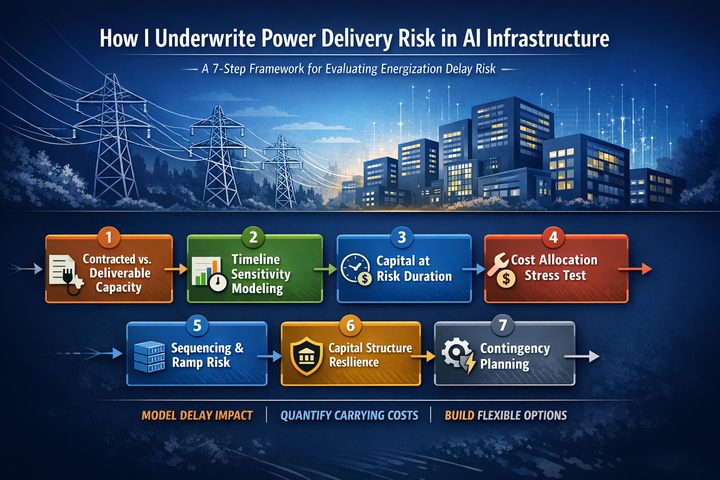

A Reuters Breakingviews piece warned that some fast growing AI tenants, including GPU focused providers, carry weaker balance sheets than the large cloud platforms. With long duration leases, huge power draws and rising build costs, the risk is that a few fragile tenants could create stranded capacity pockets if the cycle turns. Reuters

Why this matters

In plain language, not every company renting very power hungry capacity is a Google or Microsoft. Underwriting is shifting toward power plus credit. Owners are being pushed to look past headline megawatts and ask whether the counterparty will be around for ten to fifteen years.

Expansion Pipeline - Land, Build, & Power

Future build pipeline and expansion moves

River Bend in Louisiana emerges as an AI mega campus

Louisiana confirmed that Hut 8 will develop its River Bend campus as a ten billion dollar AI data center project, supported by state sales tax rebates for equipment and quality jobs incentives. The campus starts with 245 megawatts committed to Fluidstack and Anthropic and includes reserved rights for significant additional build out on and off site. Opportunity Louisiana+1

What it signals

This is a classic example of a state using incentives to convert industrial land and existing power corridors into a digital export business. Expect copycat structures in other Gulf and Midwest states that can offer relatively cheap power and large parcels of land.

Imperial Valley legal fight over a nearly one million square foot AI project

In California, the city of Imperial filed suit against Imperial County over a proposed nearly one million square foot AI focused data center and manufacturing complex, arguing that a full environmental review is required under state law. The developer says the project sits on industrial land and should proceed under existing ordinances. KPBS Public Media+1

What it signals

Projects are not just competing for power and land. They are running into procedural and political risk, especially in water stressed regions. For anyone tracking a pipeline, entitlement risk needs as much attention as megawatt numbers.

Great Lakes region tied closer to data center growth

Coverage from Circle of Blue highlighted new partnerships between Google, Meta and energy majors including ExxonMobil to support data center growth around the Great Lakes, with a focus on both power and water impacts. The piece notes that the region sits on nearly one fifth of the worlds surface fresh water and is becoming a focal point in the debate over AI infrastructure siting. Circle of Blue

What it signals

You are seeing early formation of what looks like an AI energy corridor around key water basins. For the build pipeline, that means more large campuses will chase this combination of cooler climate, ample water and relatively robust transmission. At the same time, expect tighter scrutiny from local communities and regulators.

Township level pushback slows rezoning in Michigan

In Washington Township, Michigan, planners postponed a decision to rezone land for a potential data center after several hours of resident testimony about traffic, noise and grid impact. The article paints a picture that will feel familiar to anyone in site selection. Full council chambers, last minute awareness, and a community that has never heard the phrase megawatt before being asked to approve a very large one. Planet Detroit

What it signals

Local politics is now a core part of the expansion story. Even markets that want the tax base can see projects stalled at the township or county level. In pipeline tracking, a zoning approval is no longer a box you tick and forget. It is a variable you monitor over the life of the project.

Early stage pitch for a one gigawatt campus near Detroit

Planet Detroit reported on a proposal for a one gigawatt class data center development in Van Buren Township, Michigan. The concept is still at the pitch stage but illustrates how quickly developers are scaling their ambitions once they think they have a path to power and political support. Planet Detroit

What it signals

The mental model for campus size is changing. What used to be a once in a decade build for a region is becoming a single line item in a hyperscale plan. For financial models, that means clustering of demand, lumpy capex and binary outcomes depending on whether these very large projects clear grid and community hurdles.

Sustainability, Energy, & Green Builds

Green energy and environmental builds

Google and NextEra bundle clean power and firm capacity

The expanded NextEra and Google agreements are structured to combine renewable generation with firming resources so that data centers can claim clean energy while still getting reliable power for AI loads. This is part of a broader shift where tech customers are asking for tailored products, not just generic renewable certificates. Reuters+1

Why it matters

Think of this as moving from buying generic gasoline to locking in a custom fuel blend, delivery schedule and price formula for an entire fleet. These are complex contracts that favor large, sophisticated buyers and will likely widen the gap between global platforms and smaller operators.

Google signs a twenty one year solar deal in Malaysia

Google and TotalEnergies signed a twenty one year power purchase agreement that will deliver around one terawatt hour of certified renewable electricity from a new solar plant in Kedah, Malaysia, dedicated to supporting Google data center operations in the country. Construction is expected to start in early twenty twenty six. TotalEnergies.com+2ESG Today+2

Why it matters

Long tenor, asset backed power deals in emerging data center markets show that tech is willing to underwrite the build out of local grids when it needs to. For global portfolios, it also demonstrates that decarbonization is no longer only a US and North Europe story.

Big tech leans into an all of the above power mix

Reuters reported that major platforms have been signing US deals that include gas fired plants alongside renewables and, in some cases, nuclear, in order to keep up with AI load growth. The message is blunt. They still want to decarbonize, but they are not going to wait for new transmission lines and storage to appear on their own. Reuters

Why it matters

For stakeholders who assumed data centers would be purely renewable powered in the near term, this is a reality check. The industry is shifting toward a portfolio approach to power, with more emphasis on emissions intensity over time rather than perfection on day one. That will shape community reactions and future regulation.

Energy and water spotlight on Great Lakes projects

The Circle of Blue coverage around Google, Meta and ExxonMobil partnerships in the Great Lakes region framed data centers as both an economic opportunity and a water and energy management challenge. It notes that large campuses can drive new investments in generation but also intensify competition for water and push older infrastructure harder. Circle of Blue

Why it matters

For non industry readers, this is where the abstract idea of the cloud becomes very physical. Decisions about where to place AI centers are now directly linked to freshwater policy and regional climate risk. That is going to pull more environmental groups, and eventually more bond investors, into the conversation.

Nuclear powered AI campuses on federal land enter the conversation

Reporting from Washington described a Department of Energy effort to explore using federal land to pair advanced nuclear reactors with AI data centers through new public private partnerships. The goal is to fast track both clean baseload generation and compute capacity without overloading existing grids. Roll Call

Why it matters

This is still conceptual, but it shows how far planners are willing to go to align power and compute. If even a handful of these projects move ahead, they will change the cost and risk profile of AI infrastructure and create a new class of strategic sites that sit somewhere between traditional utility assets and commercial campuses.

Government Policies & Regulatory Impacts

Government policy and community pressure

National moratorium campaign on new AI data centers

More than two hundred environmental organizations sent a joint letter to Congress on December eight calling for a nationwide moratorium on the approval and construction of new AI focused data centers until stronger regulations are in place. TechCrunch and other outlets covered the campaign, which frames AI data centers as one of the biggest emerging environmental and social risks in the country. Food & Water Watch+1

Why it matters

Even if a full moratorium is politically unlikely, the Overton window shifted. Moratorium language can quickly reappear in state level bills, local zoning fights and legal challenges. For project finance, this raises the importance of documenting community benefits and environmental performance early.

Maine groups join the moratorium push

Maine Public reported that nonprofits in the state have joined the national moratorium call, underscoring that concern is not limited to the usual coastal metros or tech hubs. The story ties AI data center growth to worries about regional grid stress and water use. Maine Public

Why it matters

Once smaller or rural states pick up the talking points, it becomes easier for legislators to introduce restrictive bills even in places that are actively chasing data center investment. The policy risk is migrating from a few high profile counties to a broader national map.

Executive order on a national artificial intelligence policy framework

The White House issued an executive order on December eleven aimed at ensuring a coherent national policy framework for artificial intelligence, including direction for agencies that oversee critical infrastructure, energy and environmental regulation. While not written specifically for data centers, it provides a foundation for more coordinated federal engagement on AI infrastructure. The White House

Why it matters

For operators, this is a signal that federal agencies will play a larger role in standards, reporting and perhaps incentives for AI related builds. Over time, it could reduce the patchwork of state rules, but in the short term it adds another layer of oversight to track.

EPA launches a Clean Air Act resource hub for data centers

The US Environmental Protection Agency unveiled a new resource site that consolidates Clean Air Act guidance relevant to data centers. The goal is to streamline permitting, explain when projects trigger major source thresholds, and clarify how emissions from related sites are counted. Environmental Protection Agency+1

Why it matters

This is a quiet but important development. It makes it easier for sophisticated developers to navigate federal air rules and potentially faster to get shovels in the ground for lower emission projects. At the same time, it gives communities and advocacy groups a clearer playbook to question projects that push the limits.

State and local reviews focus on cost and impact

Washington State released a preliminary report from its data center workgroup examining tax treatment, grid planning and the potential for cost shifts to other ratepayers in high growth regions. Washington Department of Revenue

Separately, cities in places like Californias Imperial Valley have gone to court to demand full environmental reviews before very large AI projects proceed. KPBS Public Media+1

Why it matters

The theme across these actions is the same. Lawmakers and communities want to know who pays for upgrades, who benefits from jobs and tax revenue, and how risk is shared if demand shifts. For anyone underwriting a project or a portfolio, that means modeling not just rent and power prices, but also the potential for new fees, conditions or delays tied to future policy changes.

As the world of AI infrastructure keeps changing, it's becoming increasingly obvious that companies need to stay flexible and up-to-date. The growth of technology, along with more regulations and environmental factors, is really changing how and where data centers are built. With local communities speaking up and rules getting stricter, businesses are facing a tough situation: they need to keep innovating and growing, but they also have to deal with important issues around sustainability and the impact on local areas. Moving ahead, it's not just about having strong tech solutions; it’s also about being committed to responsible development that takes both the economy and the environment into account. Those who can strike a balance between these competing interests will shape the future.

"Content is based on public information and personal analysis, not financial or investment advice."