Data Center Intelligence - Weekly Roundup (Dec 29-Jan 4)

January 4, 2026

Last week told a familiar but important story. Money is still flowing into data centers, but the real advantage is shifting toward whoever controls power, land, and approvals. Here is what moved the market and why it matters.

1) Industry trends

Acquisitions, customer commitments, capital commitments

SoftBank agreed to buy DigitalBridge

SoftBank is doubling down on the physical backbone behind AI by buying a company that owns and operates data centers and digital infrastructure.

Why it matters: This shows AI is no longer just about apps and software. The biggest bets are now on the physical places where computing actually happens, similar to buying factories instead of just designing products.

Google pushed deeper into energy and infrastructure by buying Intersect

Google is moving beyond signing power contracts and into owning the companies that build energy projects.

Why it matters: This is about certainty. When companies own their energy supply, they are less exposed to delays, shortages, and rising electricity prices that can slow down digital services everyone relies on.

Goldman Sachs raised new capital aimed at power linked to data centers

Investors are increasingly backing power generation and grid assets tied directly to data center demand.

Why it matters: This tells us the bottleneck is no longer demand for digital services. It is the availability of electricity. Capital is following the constraint.

VivoPower acquired a 40MW data center in Norway

A smaller acquisition, but in a market with stable power, cool climate, and supportive policy.

Why it matters: Not every win is massive scale. Reliable regions with predictable costs can still be very valuable, especially when larger markets are congested or delayed.

CapitaLand India Trust sold stakes in two India data center projects

This was portfolio reshaping, not an exit from the market.

Why it matters: Even fast growing markets require discipline. Investors are adjusting exposure to manage risk and timing, which is a sign the sector is maturing.

2) Future expansion

Land purchases, build adjustments, campus moves

xAI discussed plans for a third Memphis data center and nearly 2GW of capacity

AI companies are now planning infrastructure on the scale of small power plants.

Why it matters: This signals how energy intensive modern AI has become. The scale of future digital growth will directly affect local power grids and regional development.

AWS received planning approval for additional data centers in Dublin

Despite past grid concerns, projects are still moving forward.

Why it matters: Once a company secures land, power pathways, and approvals, it is very hard to replace. Early positioning matters more than speed alone.

A former automotive factory in Wales may be redeveloped into a data center

Old industrial sites are being reused for digital infrastructure.

Why it matters: This reflects how economies evolve. As manufacturing changes, data centers are becoming the new industrial anchors in many regions.

Saudi Arabia broke ground on a large government backed data center

The state itself is sponsoring large scale compute capacity.

Why it matters: Governments now see digital infrastructure the same way they once viewed roads or power plants. It is considered critical national infrastructure.

More US cities are drafting data center rules before projects arrive

Local governments are getting proactive instead of reactive.

Why it matters: Communities want clarity and control before large infrastructure arrives. This shapes where and how digital growth can happen.

3) Green energy and environmental builds

Power strategy, cooling, water, heat reuse

Finland connected a data center to a district heating system

Waste heat from servers is used to warm homes.

Why it matters: This changes the perception of data centers from energy consumers to shared infrastructure that can benefit local communities.

Waste heat reuse is becoming part of urban energy planning

Cities are beginning to plan around data centers as heat sources.

Why it matters: Digital infrastructure is increasingly intertwined with everyday services like heating, making it more visible and politically relevant.

Liquid cooling is moving from niche to standard design

Air cooling alone can no longer support high density AI workloads.

Why it matters: As computing gets more powerful, managing heat becomes as important as generating electricity. This drives higher costs and more complex facilities.

New direct to chip cooling technologies are entering the market

Hardware and infrastructure suppliers are racing to keep up with AI demands.

Why it matters: Innovation is happening because the old designs are no longer sufficient. This is a sign of structural change, not a temporary spike.

Cooling innovation is spreading beyond traditional data center vendors

More players are entering the ecosystem.

Why it matters: When multiple industries start solving the same problem, it usually means that problem is permanent and growing.

4) Government policies and public response

Regulation, permitting, incentives, community pressure

Community opposition to data centers is increasing

Residents are questioning power use, water, noise, and land impact.

Why it matters: Digital infrastructure is no longer invisible. Public acceptance can directly affect whether projects move forward.

Prince George’s County highlights the tax revenue versus impact debate

Data centers bring money but also concerns.

Why it matters: Local governments must balance economic benefits with community expectations, which can slow approvals and increase costs.

Ireland’s national planning decision for AWS shows centralized authority matters

National level decisions can override local hesitation.

Why it matters: Where permitting power sits can determine how fast digital infrastructure gets built, influencing national competitiveness.

Cities are writing data center specific zoning and standards

Rules are being set before developers arrive.

Why it matters: This gives communities leverage and creates clearer expectations, but also raises the bar for developers.

Governments are becoming anchor customers for data centers

State sponsored projects are increasing globally.

Why it matters: When governments buy compute directly, it accelerates buildouts and reshapes market demand.

What it all adds up to

Last week reinforced four realities:

• Power and permitting are now the schedule critical path, not concrete and steel

• Capital is chasing integrated plays: land, power, interconnect, cooling, and entitlement together

• Community acceptance is becoming as important as fiber routes

• Cooling and heat reuse are moving from optional sustainability talking points to design and policy levers

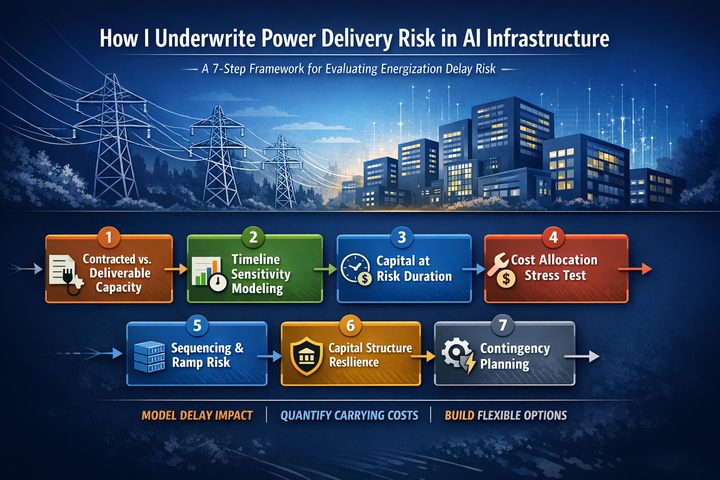

FP&A implications and modeling adjustments

• Model interconnect time as a range, not a date

Build scenarios with probability weights for grid and permit outcomes. Your base case should no longer assume “expected timeline” happens.

• Split returns into two curves: powered shell versus revenue producing load

Underwrite the option value of having land and power secured, even before utilization ramps.

• Increase contingency for electrical and cooling scope volatility

Transformers, switchgear, liquid cooling distribution, and water mitigation can swing budgets and delivery dates. Treat them as variable, not fixed.

• Add a community and policy risk factor to every new market

If a market is trending toward moratoriums, special use permits, or tighter design standards, reflect that as higher soft cost, longer cycle time, and higher legal and stakeholder spend.

• Treat power procurement and behind the meter strategy as a finance workstream

The market is rewarding teams that can price and structure power like a product. Build templates that compare utility rate cases, PPAs, on site generation, storage, and curtailment economics side by side.

The companies that win this cycle will not just build faster. They will plan better, price risk more honestly, and treat infrastructure constraints as financial realities rather than technical footnotes.

“The content is based on public information and personal analysis. This is not financial or investment advice.”